Online shopping has become increasingly popular due to its convenience and accessibility. With just a few clicks, shoppers can browse through a wide variety of products and make purchases from the comfort of their own homes. They don’t have to roam around in malls or visit different shops just to get the desired product. Just scrolling through the phone they can compare prices, read reviews, and find exclusive items that are not available anywhere have contributed to the growing craze for online shopping. The availability of exciting deals and discounts has led consumers to opt for online shopping over traditional retail shopping.

When it comes to making payments, many people use credit cards. Credit cards allow us to make purchases online and pay for them later. It’s important to use credit cards responsibly and pay off the balance on time to avoid high interest fees. Always ensure that you are making secure transactions when using your credit card online to protect your financial information. Given below are the top 10 credit cards that are best suited for online shopping. Continue scrolling down to read about all the perks and benefits these cards provide.

Top Credit Cards for Online Shopping

Flipkart Axis Bank Credit Card

The Flipkart Axis Bank Credit Card comes on top when looking for a credit card for online shopping. This co-branded card has been introduced by Flipkart and Axis Bank with the main target being online shopping enthusiasts. This card has a joining and annual fee of Rs. 500 plus taxes which can be waived on spending Rs. 3.5 lakhs or more in the anniversary year. Cardholders will get a welcome bonus worth Rs 600 on minimum transactions worth Rs. 100. This card offers 5% cash back on purchases from Flipkart, 4% cashback on Swiggy, PVR, Clear Trip, Uber, etc., and 1% cashback on online and offline spends. For travelers, one domestic airport lounge access is provided every quarter, and a 1% fuel surcharge waiver on transactions between Rs. 400 and Rs. 4,000 capped at Rs.400 per month.

Cashback SBI Credit Card

The Cashback SBI Credit Card is a popular card introduced by the State Bank of India that offers 5% cash back on every online transaction. The joining and renewal fee is Rs. 999, which can be waived on spending Rs 2 lacs or more in the preceding year. A customer will get 5% cashback on online spending with a monthly capping of Rs 5,000 and 1% cashback on offline transactions without any capping. The cashback is credited directly to the customer’s account. You will also get 2 add-ons for family members free for a lifetime. Another perk of owning a cashback SBI Credit card is a 1% waiver in fuel surcharge on fuel transactions at all petrol pumps in India.

HDFC Bank Millennia Credit Card

Issued by the most popular private sector bank, the HDFC Bank Millennia Credit Card comes with all its benefits targeted at Generation Y or the millennials. With a joining and renewal fee of Rs. 1,000 plus taxes, this credit card offers 1,000 CashPoints as a welcome bonus. You can earn CashPoints as cashback when you make purchases. You get 5% cashback when you shop on partner online websites like Amazon, BookMyShow, Flipkart, Myntra, TataCliq, etc., and 1% cashback on all other online and offline purchases. The cashback can be used for buying products or booking flights/hotels online. You used to get free access to airport lounges with this card, but now you can get a free lounge access voucher or a Rs. 1,000 voucher if you spend Rs. 1 lakh in a quarter. This card also offers up to 20% off on Swiggy Dineout and 1% off on fuel surcharge waiver, with a maximum benefit of Rs. 250 per statement cycle for all fuel transactions. If you spent more than Rs. 1 lakh in the previous year, you can get the annual fee waived.

Amazon Pay ICICI Bank Credit Card

Amazon Pay is a co-branded credit card between Amazon and ICICI Bank. This lifetime free credit card with no joining or renewal fee is popular among Amazon shoppers online. As a welcome benefit, this card includes discounts up to Rs. 2,000 and a complimentary 3-month Amazon Prime Membership. As a part of ICICI Bank’s Culinary Treats program, 15% off on all bill payments at restaurants is another attractive perk for people who like going out to eat. The Amazon Pay ICICI Bank Credit Card offers 5% cashback on Amazon purchases online for Prime members and 3% cashback for Non-Prime members, 2% cashback on partner brands & 1% cashback on all other payments except fuel purchases. A 1% waiver in fuel surcharge on fuel transactions at all petrol pumps in India is also provided with this card.

American Express Smart Earn Credit Card

With the American Express SmartEarn card, a person can earn points on everyday purchases like groceries and online food deliveries. The joining and annual fee is Rs. 495, which will be waived based on the spending of Rs. 40,000 the previous year. Members get a Rs. 500 cashback as a welcome gift on a spend of Rs. 10,000 in the first 90 days of issuance. You will get a complimentary Zomato Gold Membership for 3 months with which you can avail of free food delivery, exclusive discounts online, and VIP access at restaurants. The AmEx Smart Earn credit card will make you earn 10x reward points on online shopping for Flipkart, Myntra, Uber, Zomato, PVR, Blinkit, etc.

AU Bank Altura Plus Credit Card

Altura Plus is a lifetime free credit card that was introduced by the AU Small Finance Bank with more features and benefits than the Altura credit card. This card has no maximum reward point cap, and the user can earn both cashback and reward points. There is no joining or renewal fee, making it a better choice for beginners.

A cardholder earns 1.5% cashback on all POS retail spends. 2X reward points are earned through online transactions except for education, government, and BBPS. The cardholder earns a bonus of 500 reward points on the minimum spending of ₹20,000 or more every month. Through this card, the cardholder can redeem his reward points for E-vouchers on top brands, merchandise, flight or hotel bookings, etc. This card also provides users with 2 complimentary railway lounges every quarter. 1% fuel surcharge waiver at all fuel stations on transactions between Rs. 400 and Rs. 5,000 capped at Rs. 150 per month.

Tata Neu Infinity HDFC Bank Credit Card

The HDFC Bank introduced the Tata New Infinity HDFC Bank Credit Card in collaboration with Tata Neu with online shopping being its biggest perk. This card comes with a joining and renewal fee of Rs. 1,499 which can be waived on spending Rs. 3 lakhs in the previous year. This card offers 1,499 NeuCoins as a welcome benefit on completing one transaction within 30 days of card issuance. You will receive 5% NeuCoins on all purchases made through the TataNeu app or website. If you activate the Neu Pass on the mobile app, you will receive an additional 5% NeuCoins. You will also earn 5% NeuCoins on purchases from partner Tata brands, such as AirAsia India, Tata 1mg, Tata CLiQ, Croma, cult.fit, Big Basket, Westside, IHCL, and others. Additionally, you will earn 1.5% NeuCoins on UPI spends, with a maximum of 500 NeuCoins per calendar month. People who love traveling would love to own this card because it offers 8 domestic airport lounge access and 4 international airport lounge access annually.

HSBC Cashback Credit Card

As its name suggests the HSBC Cashback Credit Card is a cashback card best suited for shopping with all the perks and benefits. The card has a joining and renewal fee of Rs. 999 plus taxes which can be waived on spending Rs. 2 lakhs in the previous year. As a welcome benefit, this card offers an online Amazon voucher worth Rs. 1,000 on making a Rs. 10,000 transaction within the first 30 days of card issuance. For frequent moviegoers, this card offers BOGO every Saturday and 10% off HSBC Gold tickets, food, and beverages at selected PVR cinemas. 30% off on EazyDiner, 12% off on Zomato dining, and 15% off on food delivery through Swiggy are some added perks with this card. Domestic flyers can enjoy 1 complimentary airport lounge visit every quarter. Insurance cover valued at Rs. 3,00,000 for unauthorized card usage up to 24 hours before reporting loss.

Standard Chartered Rewards Credit Card

The Standard Chartered Rewards Credit Card is primarily targeted at people who love online shopping. This card has no joining fee but a renewal fee of Rs. 1,000 which can be waived on spending Rs. 3 lakhs or more in the previous year. On spending Rs. 20,000 on retail purchases, cardholders will be eligible to earn 4x bonus reward points, and a person can earn 2,000 reward points every month. This card is beneficial for domestic flyers as it offers one complimentary airport lounge access every quarter (4 annually).

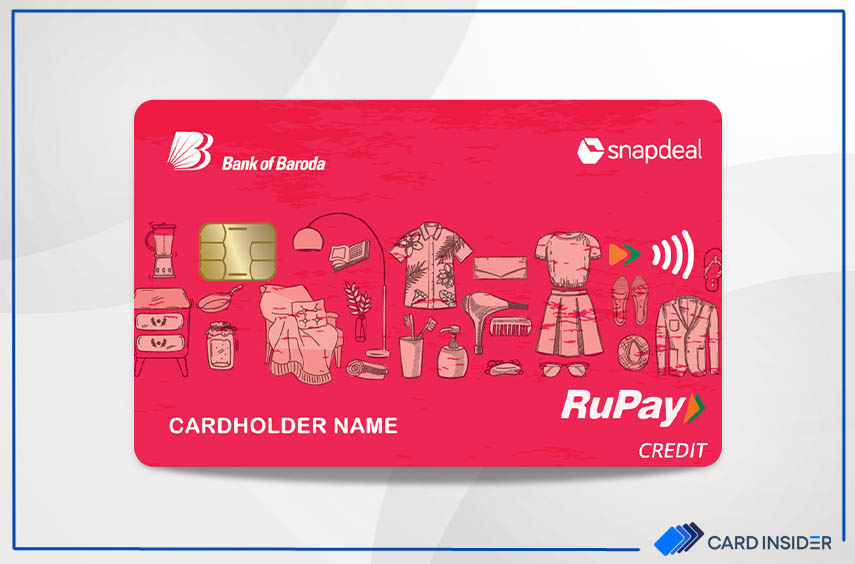

Snapdeal Bank of Baroda Credit Card

A co-branded credit card has been launched by the Bank of Baroda and Snapdeal which is best suited for online shopping enthusiasts. The Snapdeal Bank of Baroda Credit Card has a joining and renewal fee of Rs. 249 plus taxes making it affordable for people from all generations. This card offers an online Snapdeal voucher worth up to Rs. 500 on making a transaction within 30 days of card issuance as a welcome benefit. This card offers 5% cashback on shopping through the Snapdeal website or app and 2.5% cashback on departmental stores, online spending, and grocery purchases. This credit card offers a fuel surcharge waiver of 1% on fuel transactions between Rs. 400 and Rs. 5,000 capped at Rs. 250 per month. All the reward points are redeemable against the card’s outstanding balance.

Bottom Line

In conclusion, these top credit cards for online shopping in India offer great benefits and cashback rewards that can enhance your shopping experience. Whether you prefer shopping on specific websites or want a card with multiple benefits, there’s a credit card option suitable for your needs. Always remember to use your credit card responsibly and take advantage of the perks they offer to make the most out of your online shopping experience.

The top 10 recommended credit cards offer something for everyone, whether you want to save money on everyday purchases or enjoy premium perks. These cards represent the future of safe and smart online spending.