SBI Card has revised the reward-earning program for many of its credit cards starting from June 1st, 2024. As of this date, several popular SBI Credit Cards will no longer earn any reward points for government transactions with Merchant Category Codes 9399 and 9311. If your credit card has been affected, please note that these types of transactions will no longer be rewarded.

Which SBI Credit Cards Have Been Affected?

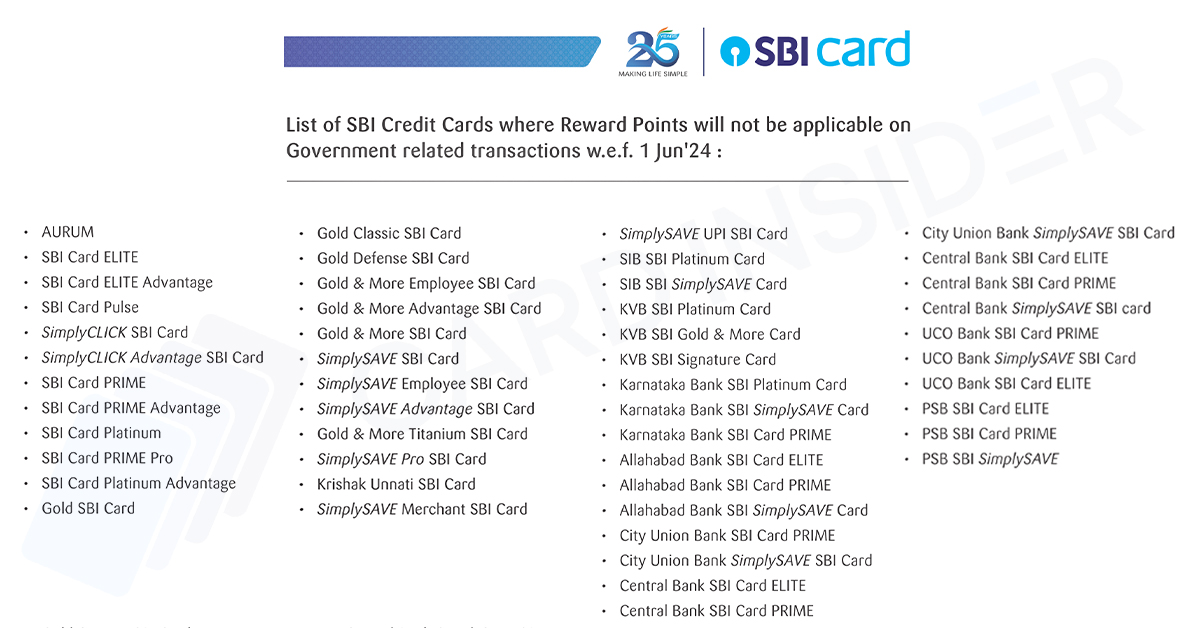

The following list includes all the credit cards that will no longer earn reward points for government transactions.

- AURUM

- SBI Card ELITE

- SBI Card Pulse

- SimplyCLICK SBI Card

- SBI Card PRIME

- SimplySAVE UPI SBI Card

Bottom Line

Previously, credit cards such as SBI Cashback did not earn any Cashback for transactions made towards government payments. However, from 1st June 2024, this list of credit cards has been expanded to include popular SBI Cards like Aurum, Pulse, SimplyClick, and SimplySAVE. This is a continuation of the removal of categories for reward point earning, which began in April when reward points for rental payments were also removed. Now, government transactions have also been affected.