Updated On

The age of digitalization has increased online purchases, making it easier for many new brands and companies to innovate and create. Brands across various categories, including online food ordering, shopping, and petrol stations, have wholly entered the credit card game. As a result, co-branded credit cards are now available for almost all categories.

Whether you are looking to buy clothes online, refuel your vehicle, or order food, there are co-branded cards with magnificent rewards and beneficial offers. Card Insider has compiled the top co-branded credit cards offered in India to get the best value deals from your favorite brands. We have assembled a list of many cards that are provided in association with some of India’s most popular brands and banks.

Table of Contents

List of Best Co-Branded Credit Cards

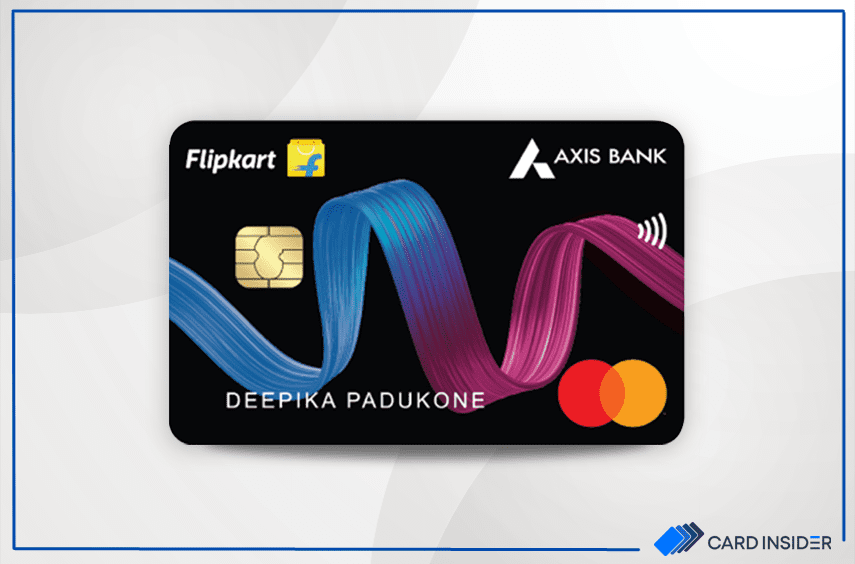

Flipkart and Axis Bank are both well-known names in India. Flipkart was one of the pioneers of online shopping in India, while Axis Bank is a popular household name. Together, they launched the Flipkart Axis Bank Credit Card, one of India’s most popular cashback cards. It offers much more than mere discounts on Flipkart purchases.

With the Flipkart Axis Bank Credit Card, you can earn 5% cashback on all purchases made on Flipkart. Additionally, you can earn 4% cashback on popular merchants such as Swiggy, PVR, Uber, Tata Play, Cleartrip, and cult.fit. This is especially beneficial as the card provides cashback on Flipkart and several other partner brands. The card also offers 4 free domestic lounge access visits, which should be sufficient for most users.

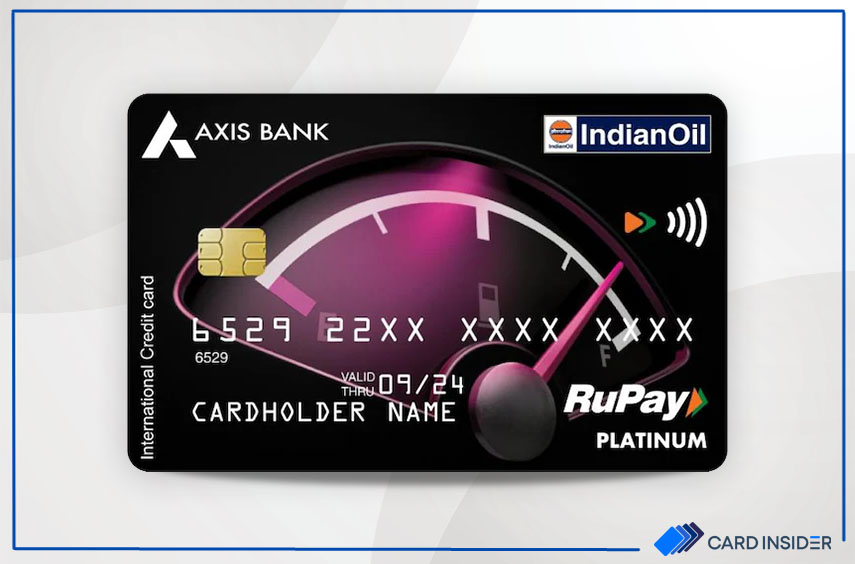

Fuel is an essential expense that we all regularly incur. Indian Oil Corporation has partnered with Axis Bank to introduce a credit card that rewards customers for their fuel purchases. This credit card allows customers to earn Reward Points on all fuel transactions made at Indian Oil outlets. They can earn 20 Reward Points per ₹100 on fuel transactions at IOCL stations, 5 Reward Points per ₹100 on online shopping, and 1 EDGE Point per ₹100 on all other expenses made with the card.

While most credit cards offer a Fuel Surcharge Waiver, only fuel-specific credit cards offer rewards or savings on fuel transactions. Additionally, avid cinema lovers can avail themselves of a 10% discount on all movie purchases at BookMyShow.

HDFC Bank currently offers two credit cards in association with Tata. These co-branded credit cards provide rewards when making purchases through the Tata Neu App and spending on Tata partner brands. The high-fee card, known as the Infinity variant of the Tata Neu Credit Cards, costs Rs. 1,499 (joining and renewal fee). Upon joining, you will receive 1,499 Tata Neu coins, which is equivalent to the joining fee. With this card, you will earn 5% back on purchases made on Tata Neu and partner brands. Moreover, selected categories are entitled to an additional 5% back. This card also gives 1.5% back as NeuCoins on UPI spends.

ICICI Bank has officially announced that it has issued the Amazon Pay ICICI Credit Card to over 4 million/40 lakh users in India. This credit card is known for its exceptional cashback offers, making it a popular choice among customers. The card is designed to provide a perfect blend of savings and simplicity. Prime users are eligible for 5% cashback on all purchases made on Amazon, while Non-Prime users can avail of 3% cashback on Amazon purchases. All cashback amounts are credited to the Amazon Pay account.

As a lifetime free credit card, you may think that this card wouldn’t have any welcome benefits. But you would be surprised to know that this card offers over ₹2,000 worth of benefits as a welcome bonus. In addition, you shall also be eligible for three months of Amazon Prime membership with the Amazon ICICI Credit Card.

The First Power Plus Credit Card is a co-branded credit card offered by IDFC Bank and HPCL. This card is designed to provide high rewards to users for transactions made at HPCL pumps. By using this card, you can earn 30X Reward Points on HPCL Fuel up to 2,400 Reward Points. Additionally, you can save up to 5% as rewards on your grocery and utility expenses. For frequent travelers, this card also provides complimentary domestic lounge access once every quarter, which means you can enjoy four free visits in a year. The IDFC HPCL First Power Plus Credit Card can be availed at a low joining fee of ₹499.

EazyDiner is a popular platform offering great deals and discounts on dining with other popular platforms. This card will be most beneficial to those who frequent restaurants regularly. Apart from great discounts and an excellent reward structure, this card also offers a free membership to the EazyDiner Prime program.

The EazyDiner IndusInd Platinum Credit Card offers 25% off up to ₹1,000 each time you dine out. IndusInd Bank and EazyDiner have also introduced a lifetime-free credit card: the EazyDiner Platinum Credit Card.

Bottom Line

All the cards mentioned above are designed to help individuals loyal to a particular brand or platform save more while purchasing. In today’s world, most of us are brand-conscious and prefer certain brands over others. To cater to this demand, various credit card issuers and brands have collaborated to offer beneficial deals that allow users to save more and at the same time increase sales for the brands themselves.

Do you have any additional co-branded credit cards you would like included in this list? Share your thoughts on the best co-branded credit cards in India by Card Insider.